Civil Aviation In China…..Moving Forward At The Speed Of Sound – September 25, 2015

Aviation Safety……….Back To The Basics – September 19, 2015

September 20, 2015

The Man Who Helped Pan American Airways Conquer The World – October 2, 2015

October 2, 2015Robert Novells’ Third Dimension Blog

September 25, 2015

Good Morning,

Welcome back to the 3DB and Happy Friday. This week I want to deviate from aviation history and talk about aviation’s sleeping giant – China. There has been much said in the recent past about China’s slowdown and how their economy is on shaky ground; however, we should not underestimate their determination to gain/maintain control on the world’s economy.

So, let’s talk about how China is putting the pieces together to dominate world aviation and the first thing I want to talk about is how Airbus, and Boeing fit in to the equation.

Enjoy…….

Airbus Industries

According to Airbus’ market forecast, China is poised to become the world’s leading country for passenger air traffic, and it already is a major geographical region for the company.

Airbus has over 1,150 of the company’s aircraft in operation with Chinese airlines as of mid-2015, which represents a 50 percent market share. This underscores the company’s progress in China, where the in-service Airbus fleet has expanded by 50 times in less than two decades.

The country also is home to a growing number of Airbus manufacturing and support operations – including its first assembly line outside of Europe. The A320 final assembly line in Tianjin began operations during September 2008 as a joint venture between Airbus and a Chinese consortium of Tianjin Free Trade Zone (TJFTZ) and China Aviation Industry Corporation (AVIC).

Airbus expanded into China in 1985 with its first delivery of an A310 to China Eastern Airlines. In 1994, Airbus China Company Limited was officially established and Airbus China Beijing Representative Office began operation. More than 1,200 people work for Airbus and its joint-ventures in China.

In Beijing, the Airbus customer support center stocks some 25,000 spare parts for dispatch to airlines in the Asia-Pacific region and was the first Chinese organization to earn EN9100 approval. Additionally, more than 20 European and American vendors supporting Airbus customers operate from the center, which also has a dedicated avionics repair workshop.

Inaugurated in 2011, Airbus (Tianjin) Logistics Center is fully operational in its facilities at Tianjin Free Trade Zone Comprehensive Bonded Area. Airbus signed a Memorandum of Understanding with Tianjin Free Trade Zone in October 2009 to establish a logistics center, optimizing the supply chain management for all of Airbus’ industrial cooperation projects in China.

Boeing Aircraft

Boeing Co has signed deals to sell 300 aircraft to three Chinese firms and set up an aircraft plant in China, becoming the first U.S. firm to clinch a business tie-up in the country since Chinese president Xi Jinping began a U.S. state visit, the official Xinhua news agency said.

The aircraft deals, potentially worth tens of billions of dollars in total, are collectively the largest order the aerospace firm has received from Chinese companies.

China’s ICBC Financial Leasing Co, a unit of the Industrial and Commercial Bank of China, on Wednesday separately confirmed it will buy 30 of Boeing’s 737-800 jets, worth $2.88 billion at list prices.

China Aviation Supplies Holding Company and China Development Bank Leasing are the other two customers for the aircraft, said Xinhua.

Boeing, which is locked in a fierce battle for plane orders with European rival Airbus, will build its first aircraft completion plant outside the United States in China in order to gain a foothold in that important market, say industry observers.

Boeing raised its forecast for China’s aircraft demand by 5 percent in August, saying that the country will need 6,330 planes over the next 20 years.

It signed a cooperation document with Commercial Aircraft Corporation of China (Comac) to build the aircraft completion center for its 737 passenger jet in China, added Xinhua. The agency didn’t disclose further details.

An aircraft’s interiors and some systems are usually installed, and the plane is painted in the customer’s livery, at completion centers. The final flight trials are then completed before the aircraft is delivered to the customer.

Boeing executives and officials from the Chinese firms could not immediately be reached for comment. Xi, who arrived in Seattle on Tuesday, is set to visit Boeing on Wednesday.

The number of air passengers traveling to, from and within China is set to nearly triple by 2034 to some 1.3 billion, surpassing an expected 1.2 billion for the United States, according to official estimates.

State-owned airlines like Air China, China Eastern Airlines and China Southern Airlines, and privately-owned budget carrier Spring Airlines, are growing fast and adding new planes to meet this demand for both short and long haul air travel.

Boeing’s plans for an aircraft completion center comes after Airbus signed an agreement in July to set up its second Chinese plant.

Now then, we all understand that Airbus, and Boeing, need to survive in a world economy that is not user friendly but what I find to be the most interesting part of this discussion is how these two companies may be getting played by the Chinese. Consider the following:

How China is playing Boeing against Airbus to build its own airplane industry

Boeing scored a huge sale to the Chinese government. In total, the planes Boeing has agreed to sell are worth about $38 billion — an enormous sum of money. That’s spread across three separate airlines and an aircraft leasing company, but all three airlines are state-owned enterprises, and the leasing company is a subsidiary of a bank that’s also state-owned.

The deal, in other words, is entirely controlled by the Chinese government, which, of course, wants a good deal on quality airplanes but also has a larger set of policy objectives.

Boeing is opening a Chinese factory to catch up to Airbus. In the United States, privately owned airlines choose to buy large aircraft from either Boeing or Airbus, Boeing’s European rival, based on a relatively narrow set of business considerations. But while the Chinese government isn’t indifferent to the quality of a plane purchasing deal it also looks at other political factors.

In recent years the bulk of Chinese aircraft purchases have come from Airbus. Not coincidentally, Airbus has a production facility in Tianjin and is opening a second Chinese factory. Boeing is now opening its own Chinese factory in part to play catch-up — and the announcement is deliberately paired with the announcement of the new sales. The message from the Chinese government to both companies is clear: Your ability to make sales in China is going to be based in part on your willingness to locate factories in China.

China is trying to learn how to make airplanes. Labor unions representing Boeing’s workforce are, naturally, concerned about the impact of the new facility on jobs for their members. But China’s leaders are really after something much bigger than a factory full of jobs. They are trying to develop a domestic aviation industry. And to do that, they need workers and managers who know how to build airplanes.

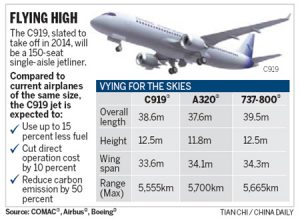

That’s why the Chinese government’s state-owned aerospace company has launched a subsidiary called the Commercial Aviation Company of China (Comec) with a mandate to build first the C919, a narrow-body aircraft intended to compete with Boeing’s 737 and Airbus’s 320, and then with a longer-term ambition to build wide-body airplanes.

The plant Boeing is going to build in China will be used to put the finishing touches on 737s and will handle the delivery and servicing of the aircraft. It’s also going to be a joint venture between Boeing and Comec. In other words, Boeing is going to be training Comec personnel in the skills they need to complete the C919 — an airplane that is designed to put Boeing out of business.

China is playing Airbus and Boeing off each other. How could Boeing be so careless about its own long-term business interests? Well, in part it’s because Boeing’s executives need to care about the company’s short-term revenue and profits, and the quarterly earnings reports don’t care about Comec’s long-term vision.

But in part it’s because Boeing believes that Comec is going to master this craft one way or the other. After all, remember that Airbus plant in Tianjin? It’s also a joint venture with Comec. So from Boeing’s perspective the die has already been cast, and it would be foolish to let Airbus gobble up the entire Chinese market for itself.

Meanwhile, Airbus is probably telling itself that helping the Chinese learn how to do final assembly for the A320 probably isn’t that big of a deal because there are a lot of other steps in the aircraft value chain and a lot of bigger, more complicated planes out there. But that’s why getting Boeing into the China game is important. Boeing’s new Chinese plant is going to be doing basically the same things as Airbus’s existing one. So if Airbus wants to regain the upper hand in competition for sales to the giant Chinese market, it will likely have to step up its future Chinese production.

Loss of Export-Import Bank subsidies plays an indirect role. Lurking in the background of this story is the Export-Import Bank, a longstanding scheme to provide discounted loans to American manufacturers that vanished early this summer after sustained attacks from Tea Party Republicans. As the American economy has shifted away from manufacturing over the decades, airplanes have become a very large share of American manufacturing exports, and Boeing became the single biggest recipient of Export-Import Bank loans. On an elite level, the main source of lobbying against the bank was Delta, an airline that didn’t like the idea of the US government subsidizing airline purchases for its foreign competitors.*

The bank’s disappearance will somewhat disadvantage Boeing in competition with Airbus for future contracts, because Europe retains its export financing subsidies. It also moderately reduces financial incentives for Boeing to keep its production in the United States.

But the main relevance is political. The aerospace industry is highly politicized, due to both the heavy government role in regulating the airline industry and the linkages between commercial aircraft production and military aircraft production. Boeing’s main competitor, Airbus, is partly owned by European governments, and its Chinese frenemy Comec is owned by the Chinese government. Government ownership isn’t really done in America, but the Export-Import Bank — along with defense contracts — was one of the US government’s main tools for supporting and influencing Boeing. With it gone, Boeing is more cut loose and more inclined to cut deals that advance China’s long-term industrial aspirations rather than America’s.

As China maneuvers itself in to a position to become a major player in the commercial aviation business equal to Airbus, and Boeing, we have to also remember that the Chinese are considering tendering an offer to buy Bombardier of Canada which also makes them a major player in the regional jet/corporate jet market. I wrote about this a few weeks ago and if you need a refresher on the specifics of that article CLICK HERE.

OK, now one last piece in our puzzle and it is called the –

SSBJ

(Supersonic Business Jet)

Sparkle Roll Group is now the exclusive sales representative for Aerion Corp.’s supersonic business jet (SSBJ) in Mainland China, Hong Kong, Macau and Taiwan. Reno, Nevada-based Aerion and Sparkle Roll, one of China’s largest CCAR Part 135/91 operators, signed the sales representative agreement this week here in Shanghai at ABACE 2015.

Aerion’s Mach 1.5 AS2 business jet–announced last May at EBACE 2014 in Geneva and priced at more than $100 million–is currently undergoing advanced design phase, during which the aircraft’s propulsion systems, structures, avionics and equipment are specified and sourced. The company is targeting first flight of the three-engine SSBJ in the 2019 timeframe, with entry into service expected in 2022.

“Sparkle Roll knows our market, knows the customer base for the AS2 and will play a key role in introducing routine supersonic flight in China and beyond,” said Aerion co-chairman Brian Barents.

“Chinese business leaders will save hours on every long-range flight in the AS2 versus a subsonic jet,” noted Mr. Li Xuefeng, chairman of Sparkle Roll Technik Co. Ltd. and executive director/CEO of Sparkle Roll Aviation (Holding) Group. “There is no question that the benefit of substantially greater speed will be highly valued by aviation users in our markets.”

SSBJ Attributes

The AS2 will have two cruise “sweet spots,” where range and efficiency are at a maximum–one at about Mach 0.95 Mach, for efficient cruise where supersonic flight is prohibited; and one at about Mach 1.4. At both speeds, total operating cost will be comparable to current ultra-long-range business jet offerings, Aerion said. While the minimum projected range is 8,797 km (4,750 nm), Aerion is aiming for 9,816 km (5,300 nm).

Its trijet configuration yields better runway performance and a lower noise profile, which is “especially important with Stage 5 noise requirements looming,” Aerion CEO Doug Nichols told AIN. The company is currently in discussions with “leading engine suppliers” to find the optimum core engine for adaptation to supersonic requirements. The selected engine core will be in the 15,000-pound-thrust range–a list that includes the Pratt & Whitney Canada PW800, GE Passport and Rolls-Royce BR710.

Inside, the aircraft’s cabin will have a cross-section dimension nearly identical to that of the Gulfstream G550, sharing the same 1.88-meter (6-foot 2-inch) height though the AS2’s width is just one inch narrower at 2.21 meters (7 foot 3 inches). The 9.14-meter-long (30 foot) cabin, which is 5.18 meters (17 feet) shorter than the G550’s, will feature a two-lounge layout, galley and both forward and aft lavatories, as well as a baggage compartment that is accessible in-flight. Outside, the AS2’s fuselage is 48.77 meters (160 feet) long, with a wingspan of 21.24 meters (70 feet).

According to Aerion, the AS2’s balanced field length is 2,286 meters (7,500 feet) at its 52,160-kg (115,000-pound) mtow. However, this can be lowered to 1,829 meters (6,000 feet) at takeoff weights below 45,360 kg (100,000 pounds) to allow for operations at airports with shorter runways or weight restrictions while retaining a trans-Atlantic range of 7,408 km (4,000 nm). This would permit the AS2 to operate from major business aviation hubs with 1,524- to 1,829-meter (5,000 to 6,000-foot) runways.

Airbus Collaboration

In September, Airbus Group and Aerion announced a partnership agreement to collaborate on “technologies associated with the future of high-performance flight.” Under the agreement, both companies will exchange knowledge and capabilities in aircraft design, manufacturing and certification.

For Aerion, this means collaboration to further develop and bring to market the AS2. “This agreement accomplishes two major objectives,” said Aerion CEO Doug Nichols. “It provides validation from the industry leader in aerospace innovation, and it decisively kicks the program into high gear. Aerion moves quickly toward building a supersonic jet, and Airbus Group gains exclusive access to our research and technology.”

Under the agreement, Airbus Group’s Defense and Space division will provide technical and certification support, including the assignment of senior engineering staff to Aerion’s development organization. Notably, the collaboration provides expanded engineering capabilities to Aerion.

Over the longer term, “Airbus gains exclusive access to Aerion proprietary research and technology, and to proprietary multi-disciplinary design tools whose accuracy has been validated in flight tests,” Nichols said. These technologies include Aerion’s extensive research in natural laminar flow airfoils, design tools and patented aerodynamic designs.

For more specifics on the SSBJ CLICK HERE.

Have a good weekend, take care/fly safe, and remember life is short – enjoy each moment.

Robert Novell

September 25, 2015